About Us

Our team brings over 135 years of operating, ownership, banking and investing experience.

We are a private family office-backed fund manager, investing as a strategic partner to lower middle market companies providing flexible debt and equity capital solutions. Our partners have worked together in various capacities for more than 20 years. Through partnerships with management, we aim to enhance operations and optimize capital structure to drive long-term growth and value creation. Our experienced team has a track record of success across a range of industries, economic cycles and situations. Primarily focused on the Southeastern US, we also consider exceptional opportunities elsewhere.

Capital Solutions

We provide capital solutions to well-positioned middle market businesses that are performing, distressed or dislocated.

EQUITY

Preferred | Minority | Majority

DEBT

Term | Subordinated | Mezzanine | Convertible

Our capital solutions are both patient and flexible. We structure the capital to match your strategy. Our investment time horizon is flexible and based on the type of capital, strategic needs, and value creation opportunity.

Capital Solutions

We provide capital solutions to well-positioned middle market businesses that are performing, distressed or dislocated.

Preferred | Minority | Majority

Term | Subordinated

Mezzanine | Convertible

Our capital solutions are both patient and flexible. We structure the capital to match your strategy. Our investment time horizon is flexible and based on the type of capital, strategic needs, and value creation opportunity.

Investment Criteria

We provide capital solutions to well-positioned middle market businesses that are performing, distressed or dislocated.

Situations

- Performing – Buyout, growth, recapitalization

- Strategic & operating support needs:

- Growth – organic, expansion or M&A

- Resource, operations, and capital optimization

- Exit strategy development

- Distressed – Good company, challenged balance sheet

- Dislocated – Refinance uncertainty and distress

Ideal Traits

- Proven business model and management team

- Identifiable competitive advantage with scalable model

- Can benefit from complimentary operational and management expertise

- Located in the Southeast US

Targeted Cashflow Range

Normalized EBITDA: $2-10 MM

Investment Size

$5MM minimum target investments

Industries

- Financial Services

- Business Services

- Healthcare

- Distribution

- Food & Beverage

- Industrial & Manufacturing

- Consumer Products & Services

- Electronics & Technology

Our Approach

We partner with owners and entrepreneurs to create long-term value.

- We listen to deeply understand company situation, needs, vision and goals.

- We identify capacity and range of outcomes and we plan together to execute strategy and secure opportunities.

- We formalize the partnership.

- We provide strategic guidance to help companies achieve their goals.

Competitive Edge

We are experienced business operators across a range of economic cycles.

We are experienced business operators across a range of economic cycles.

Our team has a proven track record of building and managing businesses across various stages and industries, from startups to successful exits to public companies. We understand the unique challenges that lower middle market companies face and how to overcome them.

We leverage our extensive experience in the banking industry and capital structuring.

We leverage our extensive experience in the banking industry and capital structuring.

Our partners include former C- and E-level banking professionals with a deep understanding of bank operations, credit processes, strategies and distressed deal management. We understand how bankers think about perceived distress to the economy, industries and borrowers, providing clients with the tools to navigate a challenging process and enhance execution.

We have uncommon expertise in successfully managing distressed company situations.

We have uncommon expertise in successfully managing distressed company situations.

We know how to assess, maneuver and thrive in distressed environments. We develop comprehensive solutions that reflect our expertise and our commitment to enhance value across diverse landscapes.

Our origination from a private single-family office has distinct advantages.

Our origination from a private single-family office has distinct advantages.

Our family office relationship gives us access to infrastructure, financial and operational expertise, and a vast network of relationships to leverage and support your success.

Family Office Advantage

Patient Capital

Long-term investment horizon, not bound by strict investment cycles. This approach allows businesses to focus on sustainable growth without the pressure of delivering immediate returns.

Stability and Consistency

Less reactive to external market pressures and fundraising cycles. Such stability can provide comfort to businesses during economic downturns when traditional sources of capital may be more constrained.

Flexibility

Flexibility to structure deals according to the specific needs of the business. Customized relationships to accommodate the company’s unique circumstances.

Diverse Investment Allocation

Our allocation across various industries with diverse economic and performance cycles enhances our ability to weather economic volatility.

Relationship-Based Investing

Prioritize building strong, long-term relationships with portfolio companies. Hands-on approach, providing mentorship and guidance beyond just financial support.

Access to Networks

Companies who secure investment from us gain access to valuable connections, potential partners, and new markets, which can accelerate the growth of their businesses.

Our Values

Collaboration

We maintain a strong sense of alignment with our portfolio companies in order to foster a sense of ownership and commitment.

Accountability

Transparency, responsibility, and ownership ensures that commitments are upheld and results are achieved.

Integrity

Our moral compass guides every action and decision, fostering trust, honesty, and a culture of high ethical standards.

Excellence

With a deep passion for what we do and a commitment for excellence, we expect the very best from ourselves and our partners.

Meet Our Team

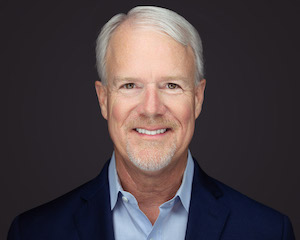

Darian W. Johnson

Chairman

Darian W. Johnson

Chairman

Read More

Darian thrives on powering strategic business growth. He has nearly 30 years of experience as a senior executive in the business incubator and finance areas, and he has been the driving force behind the launch of a number of highly successful start-up businesses in a range of industries. From single-location startups to multi-location/multi-state organizations, he has a strong, proven track record in business planning, procuring capital and guiding first-time entrepreneurs.

Darian was previously Chief Operating Officer/Chairman of the Board of Skilled Services and Vice President at First Florida Bank. Darian serves as President, Chief Operating Officer of Sembler Investments and Chairman of the Board of Immunologix Laboratories.

He earned a Bachelor of Science in business administration with a major in Finance from the University of Florida.

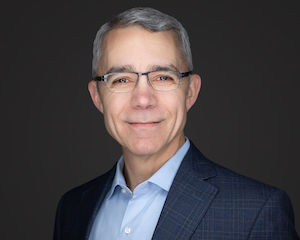

Richard A. Mocsari

Chief Investment Officer

Richard A. Mocsari

Chief Investment Officer

Read More

As one of SI Private Capital’s founding partners and Chief Investment Officer, Richard brings thirty years of experience as a financial professional, including seventeen prior to SI Private Capital as a strategically focused CFO and operator. During his various tenures in private investment, commercial banking, and investment banking, he has consistently driven exceptional risk-adjusted returns on capital and achieved desired outcomes for shareholders.

Richard’s background includes a focus on organic growth strategies, mergers and acquisitions, and capital structuring and raising activities among ownership that includes institutional private equity, hedge funds, sophisticated family offices and private investors and operators. Richard’s experience also includes repositioning distressed institutions and assets across multiple economic cycles, industries, and asset classes. His prior posts were as CFO for Beach Bancorp, Inc., Validus Group Partners, Gulfshore Bancshares, Inc., and Sembler Investments; as investment banking principal in mergers and acquisitions at CLB Partners; and VP in Bank of America’s middle market banking group.

Richard is an active Board member of Valley Lighting.

He holds a Master of Business Administration from the University of Florida and a Bachelor of Science in Finance from the University of South Florida.

Andrew G. Peterson

Credit & Portfolio Management

Andrew G. Peterson

Credit & Portfolio Management

Read More

Drew is a seasoned financial services professional with over 32 years of experience. At SI Private Capital, he leads the portfolio, credit and risk strategy, overseeing efficient production, operations, and risk structures to drive healthy, accelerated growth.

Before joining SI Private Capital, Drew built a diverse background in global and community banking environments, managing complex loan and capital structures across various industries. His expertise in mergers and acquisitions, FDIC failed bank bidding, due diligence and rehabilitating distressed loan portfolios has consistently delivered strong returns on capital and shareholder outcomes.

Drew served as Chief Credit Officer for Beach Bank and GulfShore Bank, Senior Credit Officer at Raymond James Bank and various SVP level roles in Credit and Risk Management at Bank of America.

Drew holds a Bachelor of Science in Business Administration with a concentration in Finance from the University of Florida and is a graduate of the Stonier Graduate School of Banking at the Wharton School at the University of Pennsylvania.

Henry Gonzalez, III

Originations & Operations

Henry Gonzalez, III

Originations & Operations

Read More

Henry is a proven executive-level business development leader. Over his 30+ year career, he has created and managed successful financial services production teams that consistently exceeded market expectations. He has driven the procurement of complex business customer acquisition and retention systems, while responsible for all facets of a growth culture and organization, including recruitment, incentivization, and accountability.

Henry’s balanced approach to managing risk and maximum returns has generated consistent production in excess of $100 MM annually in the middle market segment, while also maintaining responsibility for the management and risk assessment of cumulative portfolios in excess of $1 B in middle-market companies of varying sophistication and size.

Henry holds a Bachelor of Science in Business Administration with a Concentration in Finance from the University of South Florida, a Masters of Business Administration from University of South Florida with a concentration in Management and Finance, and he is a graduate of the LSU Banking School.

Travis Johnson, CFA

Travis Johnson, CFA

Read More

A Chartered Financial Analyst (CFA®) and a Professional in Human Resources® (PHR®) with a master’s in entrepreneurship, Travis has a track record of delivering value across multiple business functions and a specialty in working with early-stage companies.

During his banking career, Travis focused primarily on middle market credit but also gained capital markets experience, working extensively with the Sponsored Healthcare and Debt Capital Markets groups. He later broke into the RIA space as a portfolio strategist and eventually became the Chief Financial Officer for an RIA service provider, acting as the outsourced CFO for multiple early-stage financial services companies.

Travis holds a Bachelor of Science in Finance, with a minor in real estate, and a Masters in Entrepreneurship from University of Florida.

Hiral Patel

Hiral Patel

Read More

Hiral brings over 25 years of expertise in accounting and operations to her role as Controller at SI Private Capital. She oversees financial management, reporting, and compliance with regulatory standards, ensuring the organization’s financial integrity and operational excellence. Hiral is also a key member of the investment team on financial analysis, accounting, and due diligence matters.

Prior joining SI Private Capital, Hiral held the controller position across various financial institutions, where she was responsible for accounting and financial management, internal, external audits and exams. She was a key leader in multiple system conversions, and implementations. She has successfully repositioned numerous accounting departments, driving efficiency, accuracy and next level financial planning and analysis tools. Additionally, she has contributed her expertise to multiple successful mergers and acquisitions among private and public entities. Her commitment and knowledge have been instrumental in her professional achievements.

Hiral holds a Bachelor’s degree in Accounting, with a minor in Statistics, from Gujarat University, India.